Inside the New Banking Playbook: How Products Are Planned When AI Is the Core Logic

See how new roles and permissions give finance leaders more control and flexibility in managing spend approvals across departments.

Yashika Vahi

Community Manager

Table of contents

Share

The New Banking Playbook: How Products Are Planned When AI Is the Core Logic

At 2:07 a.m., a bank’s credit model quietly adjusts thousands of SME credit limits.

By 9 a.m., relationship managers are on the phone with confused customers.

No rules were changed. No one “shipped a feature.”

The product simply learned something overnight and acted.

When the team meets, they realize something uncomfortable:

The behavior of the product has changed, but nobody in the room can clearly explain how or why.

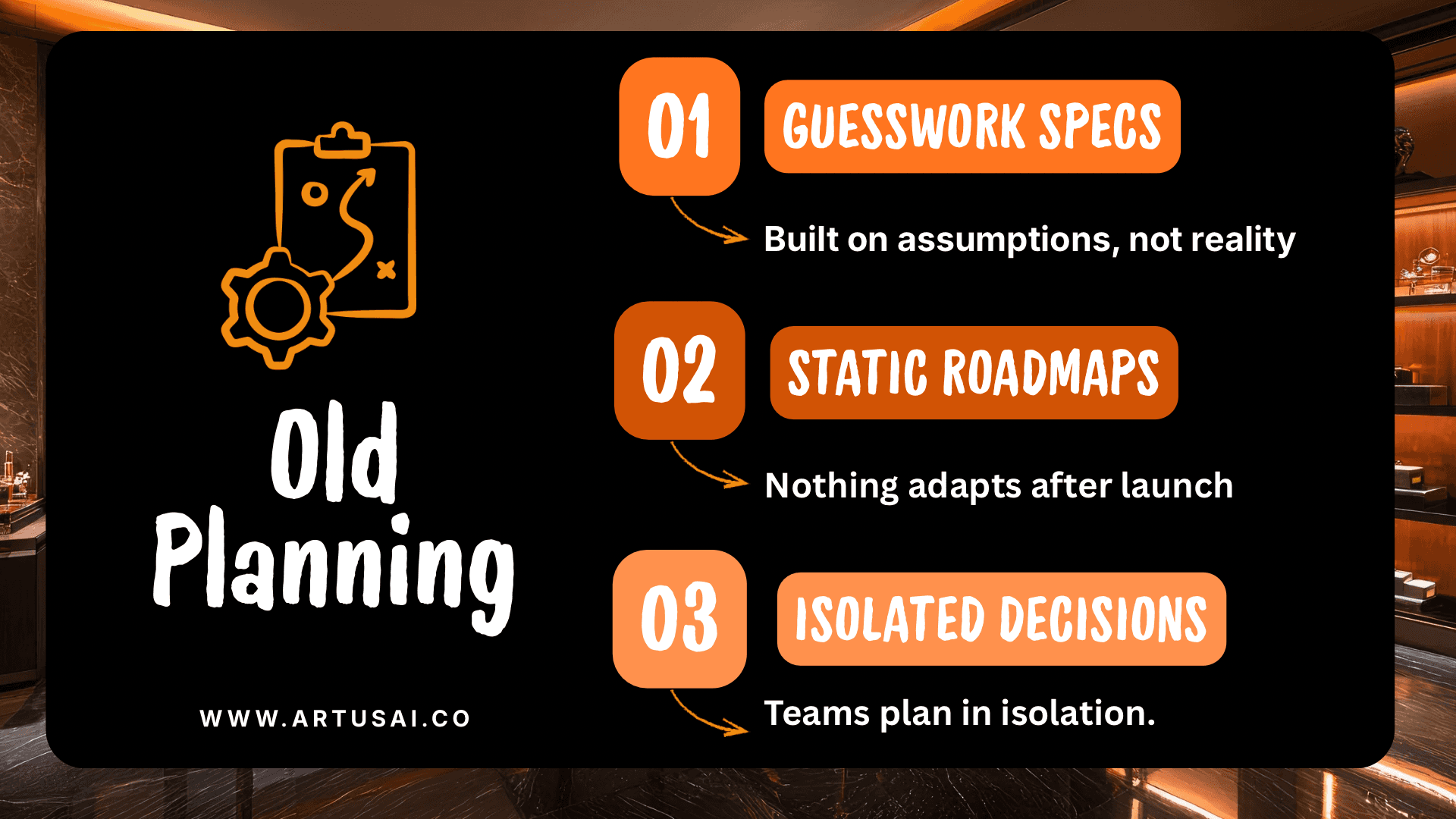

This is where the old planning model breaks.

In 2015, a bank could survive with static products:

a slightly better mobile app, refreshed rewards, maybe a nicer UX over the same core.

Planning lived in decks, spreadsheets, and requirement documents, held together by risk and compliance approvals.

In 2025, that world is cracking.

Today’s banking products are less “accounts and cards” and more learning systems: always-on models that watch behavior, adapt in real time, and change what the product is without a big version release.

And that has forced banks to rewrite how they plan, spec, and ship products.

According to McKinsey, generative AI could unlock $200–$340 billion in additional annual value for the banking industry if use cases are fully implemented.

Why Artus Is Paying Attention

Artus is not a bank. We’re a product-planning system. So why dig this deep into banking?

Because banks are a stress test for all future product planning:

They operate under hard constraints: regulation, systemic risk, public trust.

Their data is sensitive and highly audited.

Their mistakes are expensive — legally, reputationally, systemically.

Their products are increasingly intelligent systems, not static feature sets.

S&P Global Market Intelligence reports that around 50% of financial institutions are already using or developing generative-AI systems for internal use, and 41% cite conversational assistants as their main external AI deployment.

If planning can’t hold up here, it’s not ready for AI-native products anywhere.

We care about two things:

Truthful, pre-mortem style thinking: surfacing risks, failure modes, trade-offs before anything is built.

Alignment around one canonical product definition: so engineering, risk, compliance, and product are not building four different versions of the same thing in their heads.

We’re not interested in telling banks “AI will save you.”

We’re interested in asking:

“How do you plan a product responsibly when its behavior is constantly learning and evolving? And how do teams stay in control when the product is no longer static but a living, learning system?”

Banking is where that question is being answered in real time.

1. How Bank Products Used to Be Planned (2015–2019)

Before the current wave of AI, digital banking already existed: mobile apps, online portals, card controls, basic alerts. But underneath, the planning model was still old-world.

Planning Area | How It Actually Worked |

|---|---|

Source of truth | Many disconnected decks and spreadsheets; static requirement documents |

Who shaped the roadmap | Business leads + risk teams; UX and data joined late |

Understanding customers | Surveys, focus groups, slow NPS feedback |

Risk & compliance role | Stepped in at the end as final approval gate |

Use of data | Mostly reporting after launch, not planning inputs |

Release cadence | Big annual releases; long cycles |

Success metrics | Adoption numbers, balance growth, broad financial KPIs |

In short: planning focused on features, not on actual user behaviors or system dynamics.

You’d spec a feature (“instant transfers,” “card controls,” “goal-based savings”), estimate the build, negotiate with compliance, then ship.

2. Early AI (2020–2023)

Around 2020, many banks started “doing AI” more seriously:

Fraud detection moved from static rules to machine-learning models.

Risk and credit models began to incorporate more features and behavioral patterns.

Back-office operations (document processing, KYC checks, reconciliation) started getting automated.

On paper, this looked advanced. In reality, from a product-planning point of view, AI was a patch: It made existing processes faster or more accurate, it rarely changed the shape of the customer-facing product and ****planning cycles still assumed: “We design the product. Models live somewhere behind it.”

This was the “AI as infrastructure” phase. Necessary groundwork, but still fundamentally 2015 thinking with smarter tools in the basement.

One Financial Times summary of industry research notes that only about 6% of retail banks are actually “ready” for broad AI integration, even though McKinsey estimates AI could add up to $340 billion a year to banking if deployed properly—illustrating how isolated, tactical projects leave most of the value on the table.

This reveals something interesting:

Banks saw better returns when they used AI and had solid IT systems behind it — but those gains faded quickly when AI stayed isolated or treated as a one-off project.

The next phase was less about sprinkling AI on top, and more about asking:

“What if the product itself is a live model?”

3. 2025: When the Product Becomes a Learning System

By 2024–2025, three shifts hit the industry at once:

Generative AI made natural, conversational interfaces possible.

Real-time data systems became standard inside major banks.

Fintech and big-tech competition made slow, incremental updates no longer viable.

This means instead of a static “account + app + card,” the modern banking product is increasingly: behavior-aware: it watches spending, income, risk signals in real time; adaptive: pricing, limits, alerts, suggestions can change dynamically; conversational: customers can “talk” to their bank, not just tap menus; and data-centric: the core value is the bank’s ability to interpret and act on data, not just store money.

The result: a growing number of banks now treat AI as core product logic, not “a fraud-detection add-on.”

For product planning, that changes everything.

4. Case Study: Same Bank, New Planning DNA

Bank of America: Virtual Assistant Erica as a Primary Customer Surface

Erica started as a small virtual support assistant inside the Bank of America app. Today, she is the app’s front door. With more than 50 million users and 3+ billion interactions, Erica turned the mobile app into a conversational surface where customers simply ask: “What did I spend on travel?” or “Is this charge legit?”

This flipped the entire product-planning model. Screens and menu flows mattered less; intent understanding, fallback rules, regulatory-safe responses, and conversation design mattered more. Risk, UX, engineering, and compliance now co-author every spec because an AI answering customers is a completely different liability than a static screen.

Bank of America reports that Erica now averages more than 58 million interactions every month, performs work equivalent to around 11,000 full-time employees, and has cut internal IT help-desk calls by about 50%.

The lesson is simple: once customers talk to your product, your product isn’t a feature anymore, it’s a living system you have to plan, govern, and grow.

5. So What Can Product Leaders in Banking Learn from This?

A 2024 survey of financial-services firms found that over 80% of respondents said AI was already increasing revenue and reducing costs, but most also admitted they were still early in deployment beyond fraud and risk.

What can you do? | What does it mean? |

|---|---|

Start with what AI can actually do | Don’t dream first and verify later. Ask your data teams what’s reliable today and let that define what you promise the world. |

Map the system before you design the screen | Figure out where data comes from, where decisions happen, and who—human or model—is responsible. The UI should reveal the system, not hide it. |

Imagine the worst-case scenario upfront | Picture the failure no one wants to talk about. Then build logs, alerts, and recovery paths that make sure you catch it long before users do. |

Redefine “done” for a world where products learn | A feature isn’t done when it ships. It’s done when it’s monitored, explainable, reversible, and safe under drift. |

Get every team to share one mental model | Product, data, risk, and engineering shouldn’t speak four different languages. Create one blueprint everyone can point to and say: “This is the system.” |

6. Conclusion: Banking as a Test Case for Planning in the Age of Intelligent Products

Banking in 2025 is not just a story of AI adoption; it’s a story of planning under pressure.

The industry is being forced to move from:

features → behaviors,

static specs → living systems,

after-the-fact risk reviews → built-in pre-mortems,

siloed ownership → shared, auditable product definitions.

One recent analysis by Business Insider of nearly 5,000 banking processes estimates that 44% of the work banks do today will be “redefined” by AI by 2030—through automation, redesign, or resequencing of tasks.

Some banks — JPMorgan, Bank of America, DBS, and a quiet handful of others — are already operating like this. Many more are still trying to do 2015 planning with 2025 technology, and they feel the friction daily.

The lesson extends far beyond finance:

Any product that embeds learning systems will eventually need banking-grade planning discipline.

That’s why Artus is watching this space so closely. Not to claim that planning is “solved,” but to learn and help teams across industries with planning tools that match the complexity of the products they’re now shipping.

Because in the age of intelligent products, the real competitive advantage isn’t just AI.

It’s whether your planning is smart enough to handle it.